Watch the recap of our recent webinar

Scaling Impact: Advancing Resilient Economies for Refugees and Host Communities.

Transforming economies and lives through impact-linked loans and technical support for SMEs in refugee hosting areas.

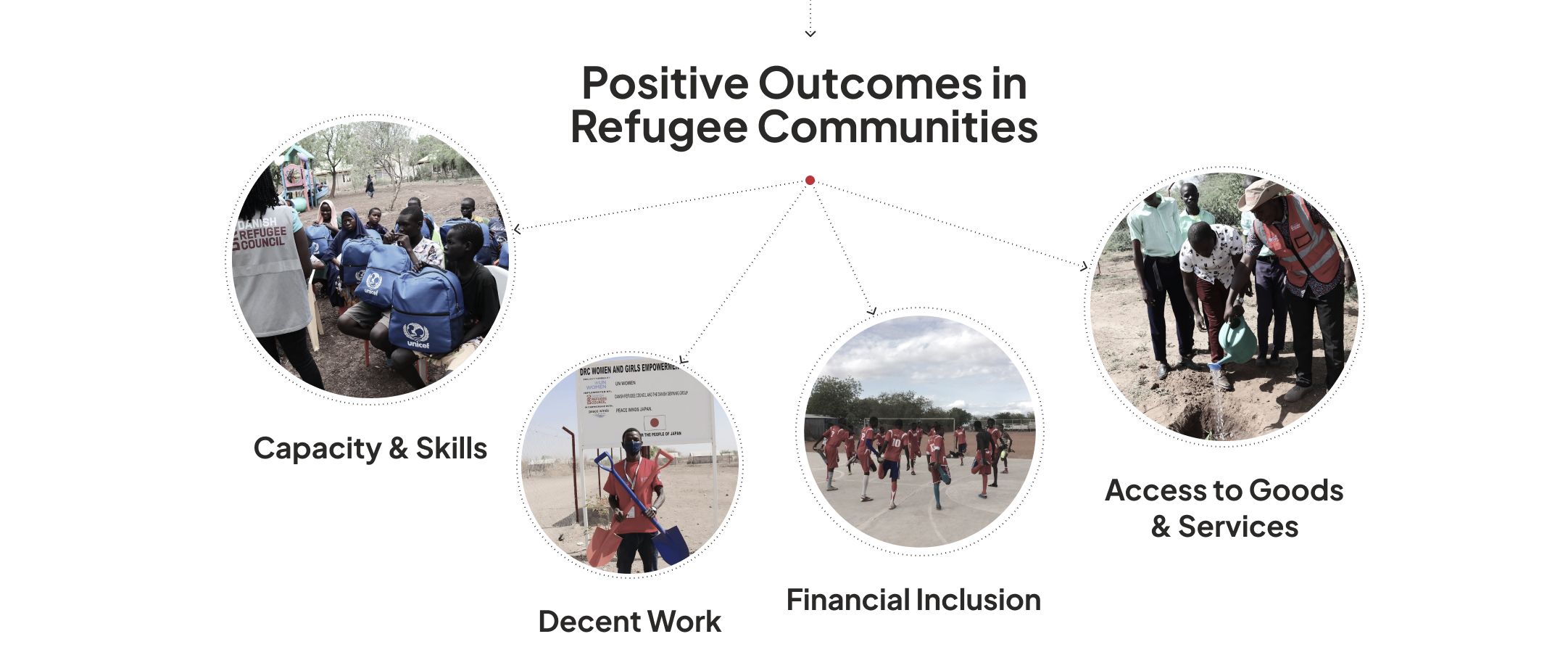

Discover the businesses that are driving change and creating impact throught their partnership with the RIF. Our featured investees, Omia Agribusiness, Ag-Ploutos, Okeba, FINCA Uganda, Ali Dates and OMIPA Cooperative Savings and Credit Society (SACCO), exemplify the success of our investment model and the positive outcomes it fosters in refugee-hosting communities.

FINCA Uganda, part of the global FINCA Impact Finance network, supports financial inclusion by offering loans, savings, and financial literacy training to underserved communities, including refugees. With 30 branches nationwide, the institution is expanding tailored services for refugees in settlements and urban areas, aiming to reach over 3,000 refugee clients by 2029.

Ali Dates, based in Jordan’s Jordan Valley, produces premium Medjool dates while maintaining a strong social mission. The company provides dignified employment to refugees and vulnerable host community members, with RIF’s Shariah-compliant loan enabling expansion into sorting services, doubling seasonal employment and increasing the number of full-time positions.

OMIPA Cooperative Savings and Credit Society (SACCO), based in Isingiro District in southwest Uganda, provides affordable loans, savings, and financial literacy training to farmers, micro-entrepreneurs, and refugees. With more than 6,800 active members and ~2,556 active borrowers each year, OMIPA also serves communities in Mbarara, Ntungamo, Rakai, and Rwampara through its operational branches situated within Isingiro. With a strong presence in Nakivale settlement, OMIPA is actively expanding its refugee portfolio through tailored financial products and aims to reach over ~4,000 refugee clients by 2028.

Discover the businesses that are driving change and creating impact throught their partnership with the RIF. Our featured investees, Omia Agribusiness, Ag-Ploutos and Okeba, exemplify the success of our investment model and the positive outcomes it fosters in refugee-hosting communities.

Omia provides smallholder farmers with access to agricultural inputs, farming equipment (such as irrigation), and animal husbandry inputs, free training and extension services on agricultural and animal husbandry practices.

Ag-Ploutos is fortifying food supply chains and unlocking market opportunities for farmers in Ugandan refugee settlements.

Okeba Uganda Ltd is driving agricultural growth in Uganda by aggregating, processing, and marketing maize, soybeans, and beans. In the second season of 2023, Okeba sourced from 8,000 farmers, of which 2,500 (31%) were refugees.

FINCA Uganda, part of the global FINCA Impact Finance network, supports financial inclusion by offering loans, savings, and financial literacy training to underserved communities, including refugees. With 30 branches nationwide, the institution is expanding tailored services for refugees in settlements and urban areas, aiming to reach over 3,000 refugee clients by 2029.

Ali Dates, based in Jordan’s Jordan Valley, produces premium Medjool dates while maintaining a strong social mission. The company provides dignified employment to refugees and vulnerable host community members, with RIF’s Shariah-compliant loan enabling expansion into sorting services, doubling seasonal employment and increasing the number of full-time positions.

OMIPA Cooperative Savings and Credit Society (SACCO), based in Isingiro District in southwest Uganda, provides affordable loans, savings, and financial literacy training to farmers, micro-entrepreneurs, and refugees. With more than 6,800 active members and ~2,556 active borrowers each year, OMIPA also serves communities in Mbarara, Ntungamo, Rakai, and Rwampara through its operational branches situated within Isingiro. With a strong presence in Nakivale settlement, OMIPA is actively expanding its refugee portfolio through tailored financial products and aims to reach over ~4,000 refugee clients by 2028.

Watch the recap of our recent webinar

Scaling Impact: Advancing Resilient Economies for Refugees and Host Communities.

If you’re a potential investor, partner, or team member please send us a note.

© 2024 Refugee Investment Facility. All rights reserved.